January 2025 Real Estate Market Report

- Jan 13, 2025

- 2 min read

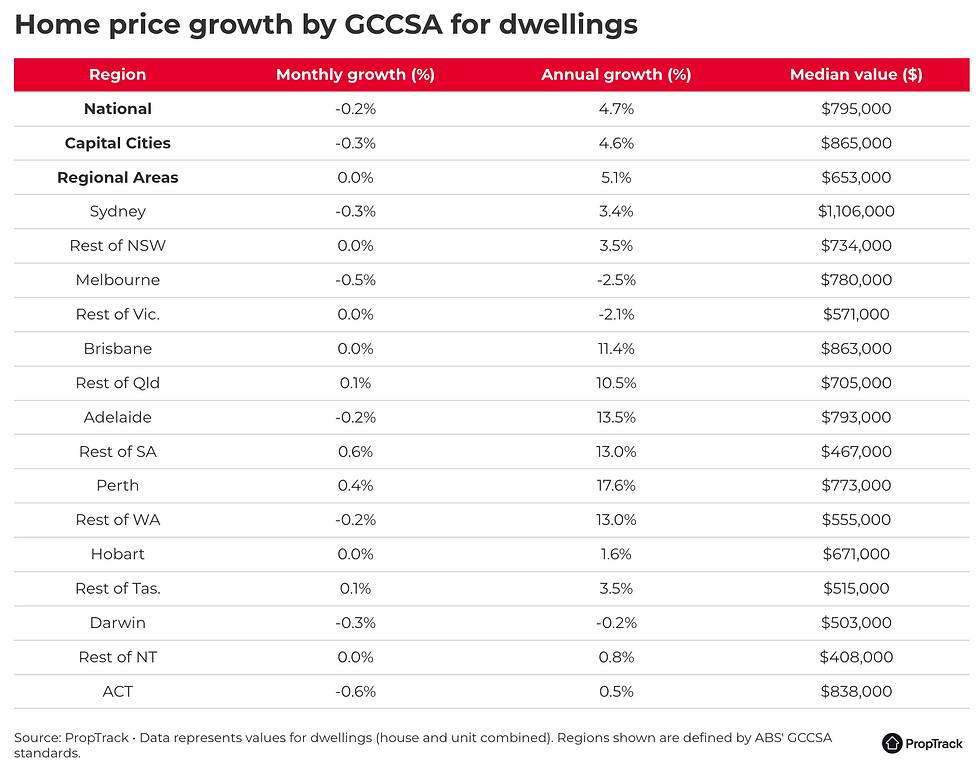

National home prices in Australia experienced a decline in December for the first time in two years, with the median value dropping by 0.17%. This decrease marks the first monthly dip since December 2022, following a 23-month streak of rising prices.

Key insights from the December 2024 report include:

The national median home price fell to $795,000, a decrease of $5,000 from November, although it remains 4.73% higher than a year ago.

Capital city prices led the decline, falling by 0.25%, while regional areas showed resilience with a slight increase of 0.03%.

The largest drops were seen in Canberra (-0.61%) and Melbourne (-0.53%), while Perth (+0.39%) was the only capital city to experience price growth in December.

Most regional areas maintained stable prices, with regional South Australia (+0.60%) emerging as the best performer.

January 2025 Real Estate market update:

Despite the monthly decline, home prices are still significantly higher than a year ago, reflecting a 4.73% increase. Notably, national home values have surged by 45.1% since March 2020. Over the past year, Perth has been the strongest performer, with prices up 17.59%, while Melbourne, lagging behind, has seen only a 13.9% increase since March 2020.

The slower price growth in Melbourne can be attributed to increased housing supply and a reduction in property investor activity. As a result, Melbourne has slipped to the fifth most expensive capital city, expected to be surpassed by Perth in median home values by 2025.

In contrast, regional areas continue to show stronger performance, with overall prices rising 5.12% year-on-year compared to 4.59% in capital cities. The trend of migration from urban centers to regional locations persists, driving demand and competition for housing in these areas.

December also saw both house and unit prices decline by 0.17%, with houses slightly outperforming units in annual growth. The strongest regional markets for price growth were found primarily in Queensland and Western Australia, highlighting a diverse and variable market landscape across the country.

As we move into 2025, the market is expected to continue experiencing varied conditions, with some regions showing strong growth while others face declines.

Grab the latest real estate market report:

Have questions about this January real estate market report? Or are you considering buying or selling a property and seeking to understand the current market conditions? Call Greg Pratt at 0413 624 308 today and grab the latest update!

Comments